Nội dung toàn văn Official Dispatch No. 16109/BTC-CST on the implementation of the ordinance amend

|

THE

MINISTRY OF FINANCE |

SOCIALIST

REPUBLIC OF VIET NAM |

|

No. 16109/BTC-CST |

Hanoi, December 31, 2008 |

|

To: |

- Ministries,

ministerial-level agencies and government-attached agencies; |

On November 22, 2008, the National Assembly Standing Committee issued the Ordinance Amending and Supplementing Article 6 of the Ordinance on Royalties, which takes effect on January 1, 2009.

Based on its assigned functions and tasks, the Ministry of Finance has collaborated with ministries, branches and localities in drafting and submitting to the Government for consideration and promulgation a decree detailing the implementation of the Ordinance on Royalties and the Ordinance Amending and Supplementing Article 6 of the Ordinance on Royalties. This draft decree is being commented by cabinet members and expected to be issued in the near future.

To strictly implement the Ordinance Amending and Supplementing Article 6 of the Ordinance on Royalties, the Ministry of Finance guides the temporary application of royalty rates from January 1, 2009, to the time a decree detailing the implementation of the (amended) Ordinance on Royalties and the Ordinance Amending and Supplementing Article 6 of the Ordinance on Royalties to be issued by the Government takes effect, as follows:

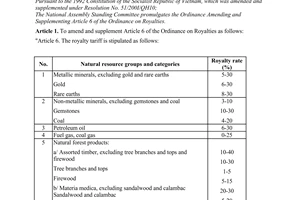

1. Natural resources eligible for minimum royalty rates in the Royalty Tariff specified in Article 1 of the Ordinance Amending and Supplementing Article 6 of the Ordinance on Royalties include:

a/ Coal of all kinds (pit anthracite coal, open-cast anthracite coal, lignite, fat coal and other coals): The royalty rate of 4% shall apply.

b/ Gems of all kinds (diamond, ruby, sapphire, emerald, alexandrite, precious black opal; adrite, rodolite, pyrope, berine, spinel, topaz, crystallite quartz, chryzolite, precious opal, feldspar, birusa, nephrite and other gems): The royalty rate of 10% shall apply.

c/ Soil exploited for ground leveling and work construction and embankment, apatite, serpentine and other non-metallic minerals (specified in Clause 6, Section II of the Royalty Tariff attached to the Minister of Finance’s Decision No. 16/2008/QD-BTC of April 14, 2008): The royalty rate of 3% shall apply.

d/ Crude oil: For oil and gas contracts under investment promotion projects with an exploited output of up to 20,000 barrels/day, the royalty rate of 6% shall apply. For mines which royalty rates have been approved by the Prime Minister, the Prime Minister’s approval decisions shall be complied with.

e/ Tree branches and tops: The royalty rate of 10% shall apply.

2. Royalty rates for other natural resources (not mentioned in Clause 1 of this Official Letter) continue to comply with current documents, specifically:

a/ Natural gas and crude oil (under oil and gas contracts with an exploited output of over 20,000 barrels/day and oil and gas contracts not under investment promotion projects with an exploited output of up to 20,000 barrels/day) are subject to the royalty rate specified in the Government’s Decree No. 48/2000/ND-CP of September 12, 2000, detailing the implementation of the Petroleum Law applies. Particularly for coal gas, the royalty rate corresponding to the exploited output of natural gas specified in Article 45 of Decree No. 48/2000/ND-CP.

b/ Other natural resources are subject to the royalty rates specified in the Minister of Finance’s Decision No. 16/2008/QD-BTC of April 14, 2008, adjusting royalty rates in the Royalty Tariff attached to the Government’s Decree No. 68/1998/ND-CP of September 3, 1998, detailing the implementation of the (amended) Ordinance on Royalties, and the Government’s Decree No. 147/2006/ND-CP of December 1, 2006, amending and supplementing a number of articles of Decree No. 68/1998/ND-CP.

3. Royalty payers, royalty-liable objects, and royalty bases, registration, declaration, payment, finalization, exemption or reduction continue to comply with current guiding documents. When the Government promulgates a decree detailing the implementation of the (amended) Ordinance on Royalties and the Ordinance Amending and Supplementing Article 6 of the Ordinance on Royalties, which specifies royalty rates different from those temporarily prescribed in this Official Letter, the royalty payers’ obligation to pay royalties shall be re-determined under such decree.

The Ministry of Finance notifies the above opinions to concerned agencies, organizations and individuals for information and implementation.

|

|

FOR

THE MINISTER OF FINANCE |